European leaders were busy last week trying to defuse the explosive situation in Spain. Mario Draghi, President of the European Central Bank gave assures that BCE ‘is disposed to do everything necessary to preserve the Euro..’. Angela Merkel, German Chancellor, and French President Francois Hollande made a joint statement displaying their determination ‘to protect the Euro’. The President of the Euro Group, Jean-Claude Juncker, confirmed that if necessary the countries in the group were prepared to buy public bonds from the countries with problems.

After the verbal fireworks, the country risk of Spain fell 50 points and the share index Ibex rose to 6.700 points.

The bubble that burst

However, at the meeting of the European Central Bank on Thursday morning, President Mario Draghi had to deflate the bubble that he himself and other European leaders had inflated, when he declared that the bank and the rescue mechanism was not yet prepared to intervene massively in the debt market, and moreover, that the countries who wanted the ECB to buy their debts, had to apply for this assistance from the rescue funds.

The Ibex fell immediately 5% and the country risk rose to 572 points, with the interest rate for bonds over 10 years almost touching 7%.

With this Rajoy is with his back to the wall, with rethorics as his only weapon.

Moody’s: Negative outlook for Germany

Rating Agency Moody’s has looked at the financial situation of Germany and found that the country is guarantor for 310 billion euros assistance for other Euro countries, including savings in Spanish banks, where the German part amounts to 30 billion. The Agency did not change the triple A rating of the country, but rated the outlook as negative. Some of German banks and regions have been given a warning.

It is obvious that even if the motor of Europe is still running smoothly, there are limits to the assistance Germany can render other countries.

Rajoy face saving

After trying to save his face by insisting that the 100 billion euros Spain got to save its banks, was not a rescue of the country, even though it is clear that the government agency FROB will distribute and supervise the use of the funds, and that the Spanish State is responsible for its repayment, the Prime Minister has started another action to try to save his face (I cannot understand why….).

Last Friday, Reuters news agency, reported from ‘reliable sources within the Euro Zone’ that Spanish Minister of Finances, Luis de Guindos, in a meeting with his German colleague Wolfgang Schaüble, admitted Spain needed a total rescue from the European Union and IMF of 300,000 million euros if the cost of borrowing in the markets remained at its present unsustainable level (in addition to the 100,000 million given to the banks).

Reuters reported that Schaüble asked that the question be delayed until the permanent rescue fund (MEDE) is established after the summer.

The Vice-President of the Spanish Government, Soraza Saenz de Santamaria, has denied the Reuters report.

The rescue of Spain will cost much more than 300,000 million, some economists have estimated it will need to be 650,000 million euros.

From Eurobonds to banking licence

The Latin countries in the Euro Group, meaning Spain, Italy and France, are constantly coming up with new proposal to ensure they benefit from the secure financial standing of the northern countries, over and above the commitments they already have in the existing agreements. Firstly it was the Eurobonds, more recently it is a proposal that the European rescue fund should be given a banking license in order that requests can be made on the new funds without limits set by the European Central Bank.

Germany and other northern European countries have refused to support the proposal of such a licence.

Regional governments against debt limits

The regional governments of Andalusia, Catalonia, Asturias and Canarias have protested against the debt limits central government is trying to impose on the regions. Catalonia boycotted a meeting called by Minister of Economy, Cristobal Montoro.

The Rajoy Government needs agreement with the regions on its drastic deficit cuts, since the regions are responsible for a large part of the financial excesses in Spain over the past years.

Capital leaving Spain

In the first five months of the year the net outflow of capital from Spain reached 163,185 million euros; the net inflow was 14,294 million. Some of the money flowing out is from the rescue fund to save the banking sector. Instead of using it for loans to families and businesses in Spain, the banks are putting it in safe heavens abroad.

The big banks: including Barclays, BBVA and Deutsche Bank have reduced their investments in Spanish debts, to protect themselves against the risks signified by the country. Between March and June, BBVA reduced its holdings in Spanish bonds by 1,600 million euros. Deutsche Bank has over the last quarter reduced their debt holdings by 35%, whilst Barclays has cut its holdings by 13% to 2,815 million euros, indicating that they fear financial losses in the event that one or other countries will leave the Eurozone and devalue its local currency.

Notices

New, drastic cuts

At the beginning of July, the Government decided on a new round of drastic cuts in public spending and tax increases, which are intended to reduce the country’s huge budget deficit by 65,000 million euros over the next 2 years.

The main points in the new program are:

- An increase of 3 percentage, to 21%, in the standard rate of IVA (VAT) with the lower rate increasing from 8 to 10%.

- The deduction of up to 400 euros on earned income is withdrawn, as too is the deduction in tax for the purchase of a new permanent dwelling.

- The conditions for obtaining the extra support by the long-term unemployed will be more complicated.

- Tax on tobacco is increased.

- Public employees will see their salaries reduced by 5.7%.

New unemployment record high: 2.63%

The second quarter ended with a record level of unemployment (in spite of the tourist season producing 53,500 jobs) to a total of 5,693,100 or 24.63% of total work force. Unemployment, of the under 25 year olds, rose to 53%.

In the second quarter an additional 9,300 more families were without any member in work, meaning a total of 1,737,600 families in this desperate situation.

Unemployed marching

Unemployed workers, and those hit by the Government’s cuts, have been marching, some from their home provinces to Madrid, others from their desks in public administration offices to the Government Moncloa Palace, or blocking the Paseo de la Castellana, a principal Madrid street, protesting against the drastic cuts in their standard of living and demanding the resignation of the Rajoy Government.

In some places there were disturbances involving the police, and some demonstrators being arrested.

On 20th May, 100,000 protesters took part in a mega-demonstration, with public employees in the front line. In 80 Spanish towns similar demonstrations took place. In Valencia the demonstration was led by police officers of the local police, under the slogan ‘Thieving politicians’.

82% do not believe in Government

The Rajoy Government has lost the support of the Spanish people. In a recent poll, 82% (72% of them PP voters) declared that the government is not sticking to its pre-election promised program; 65% are against the increases in VAT; 84% the cuts in unemployment support, and 72% for their intention not intending to pay the Christmas bonus to public employees. However, 92% are in support of the plan to reduce the number of local councillors and 88% want that measure extended. 73% say Rajoy is giving up too much sovereignty to obtain financial support for the banks and 80% criticise PP for defending the management of Rodrigo Rato (Minister in previous PP government) in Bankia.

Parliament barricaded

The National police have barricaded the Parliament Building and restricted access to Carrera de San Jeronimo (the street leading to the building). The leftist federation IU in Parliament is demanded the dismantling of the barricades, saying that ‘the Deputies do not need to be defend from the citizens.’

52.1% youth unemployment

Eurostat reports unemployment among the under 25 year olds, at 52.1%, has reached an historic record in Spain. Greece has a similar level, whilst Portugal records show 36.4% and Italy 36.2 unemployed.

Total unemployment in Spain, at 24.6%, is the highest in the EU, despite 98,853 people finding short-term, tourist season contracts, in June.

‘No money in Treasury’

In a parliamentary debate in the middle of July, in which the socialist opposition attacked the government for suppressing some of the extra holiday days enjoyed by public employees and the additional month’s salary at Christmas, the Minister of Economy, Cristobal Montoro suggested that the opposition should assist in the collection of taxes, saying that public employees, ‘Know better than anyone else that there is no money in the Public Treasury and if the collection of taxes does not improve, we are in danger of not being able to pay their salaries …..’

Recession deepening

The Spanish economy contracted 0.4% in the second quarter, compared with last year. Inflation increased 0.3% in June, up 2.2% on the same month last year. The Office of Statistics explain the rise as the result of the higher price of medicines.

Tourists spending more

Foreign tourists in Spain in the first half of the year spent 5.6% more than at the same time last year. Total income on tourism was 23,644 million euros. The increase is due to both more foreign tourists (an increase of 2.9%) as well as a higher-spend per day and per person.

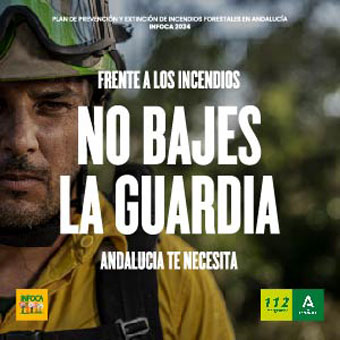

9,844 forest fires

Between 1st January and 22nd July, there were 9,844 forest fires in Spain; 3,635 of which covered more than 1 hectare. A total of 38,267 hectares were destroyed.

Protests against new Law of the Coasts

Two hundred organisations and ecologists groups have protested on 20 beaches against a new version of the Law of the Coasts. The ecologists hope to stop the new law, which they consider is an attack on the sustainability of beaches and opens the door to urban planning illegalities.

Bank profit falls

The gains previously seen by Banesto, fell 97% in last quarter; Caixabank profits shrunk 78% and those of Banco Popular declined by 37%. Banco Santander profits fell 35.4% in the first half of the year. Banks have had to use all sources possible to put together enough reserves to cover bad property loans. The chief financial officer of Banco Popular, Gonzalez- Robatto declared that the ‘real estate crisis is worsening and more developers are throwing in the towel.’

National court judge Gomez Bermudez has presented a number of charges against five former Directors of the Alicante savings bank CAM and has demanded they pay a guarantee sum of more than 25 million euros. CAM has now been taken over by Banco Sabadell.

Higher tax on buying re-sale dwelling

Several of the regions, including Murcia, Valencia and Catalonia, are planning to increase the ‘Impuesto de Transmisiones Patrimoniales’ (tax on purchasing a re-sale dwellings). The regions may decide on the percentage themselves: It is expected to be 3% to 10%, and will be paid by the buyer.

Prices in EU

Denmark with 142 points and Sweden 138 points on a scale where the average is 100, are the most expensive EU countries. Germany is just above the average, with 103 points and UK is even closer at 102. Spain, with 97 points, is barely below, close to Greece 95. The cheapest of the EU countries is Bulgaria, at 51 points.

Inflation in Spain so far stands at only 1.9%, due to the fall in prices for gasoline. However, the increase of 3% in IVA will certainly be felt by consumers.

King cuts his salary by 7%

The King has decided to cut his salary to 272,752 euros per year, down 7%. The Crown Prince’s income will also be 7% lower. Payments to the Queen and the Princesses will also be reduced, however, Princess Cristina will hardly feel any loss: She is married to Iñaki Urdangarin (who is in court for alleged fraudulent business ventures that could result in imprisonment for 18 years for a normal citizen) Telefonica has, nevertheless, renewed their contract with him for one more year, worth 1.5 million euros, plus another 1.2 million in expenses !

Emigration from Spain

Spanish citizens are emigrating in increasing numbers. In the first half of this year 40,625 left the country to settle elsewhere, up 44% on the same period last year. The principal countries of settlement are UK, USA, Germany, Ecuador, and Venezuela.

Only 24% speak a foreign language

Those EU countries in economic difficulties, Portugal, Greece, Italy, Spain, and Ireland, are also the countries where foreign languages are rarely spoken. In Spain, only 24% of the adult population have a foreign language.

Paying for medicine

One must now contribute to the cost of prescribed medicine, in line with your income.

Your Spanish health card will show a code indicating your income level (TSI 001 for low income, not having to contribute) TSI 002 for retirees. Those with an income of up to 18,000 euros will pay 10% of the cost. Those with an income from 18,000 to 100,000 p.a. (TSI 003) will pay 40%. Those coded TSI 004 will pay paying 50% and TSI 005 is for those with income over 100,000 euros that will pay 60% of the costs.

If you have no code on your health card? Ask in your pharmacy or local health centre!

N.B: Unless you live in Andalucía, where uniquely, for those who have been correctly making a tax declaration, the amount to be paid is automatically shown on the computer at the pharmacy. When the appropriate maximum monthly payment is reached (8 euros for the lower category) the charge is automatically cut off.

Reduced traffic in crisis

Due to the crisis and increasing unemployment, traffic levels fell 15% in Spain during 2011. Spanish drivers lost 34 hours in queues last year, six hours less than in 2010, with the city of Seville seeing the biggest reduction, thus saving the average driver 10 hours.

Now comes evictions

Spanish courts dealt with 58,241 cases involving unpaid mortgages re-payments in 2011, an historic high and 22% above that of 2010. As a result of court cases, the number of evictions is rising: Valencia being the region most affected, with 13,711 evictions, followed by Andalusia 9,864 and then Madrid 9,460.

PP drops in polls

Not surprisingly, the governing Partido Popular has dropped 9 points in the polls since the elections in November. Also, not surprisingly, the previous governing party, PSOE, has not benefited from this catastrophe for PP; gaining only 0.8%.

Leftist Izquerda Unida has increased its support 5% since the elections, and the new party UP&D is 3% stronger.

Bad debts soaring

The percentage of bad debts on bank loans made to developers is soaring, and at the end for the first quarter had reached 22.8% of all outstanding loans to the property sector. The situation regarding loans to builders is just as bad: Of the 96,194 million borrowed, 20.9% has gone sour, up from 5% only 3 years ago.

Bad loans are rising fastest in the hotel sector. At the end of 2008, they had reached only 2%. Today it is more than 9%.

Obscure financing of political parties

The European Council has released a report on the financing of political parties in which Spain is severely criticised. The political parties have not suffered the credit restrictions that families and companies have experienced. From December 2007 to December 2010 Saving Banks increased loans to political parties by 8%, to 85 million euros.

One third of these loans were to the socialist party PSOE, which over the past three years has increased their loans from the Caja’s by 17%.

King sacked as honorary President in WWF

After his hunting trip to Botswana to shoot elephants, King Juan Carlos has been removed from his position as Honorary President of WWF (the World Wildlife Fund) in Spain. The decision was made in an extraordinary meeting; 226 votes to 13. His Majesty Juan Cralos had held the position since 1968.

Less ‘Regional Embassies’

Due to lack a of funds, some of the regions which opened their own offices abroad have had to close or incorporate them with the regular Spanish Embassies abroad. There are now 166 such regional delegations abroad, down 26 from the 192 of two years ago.

The regions of La Rioja, Valencia and Castilla Leon have closed down their overseas offices; Aragon, Galicia and Navarra are contemplating following suit. Catalonia is still refusing to close their 48 foreign ‘embassies’ in spite of staggering debts.

Hunger in Ciudad Real

Nemesio Lara, President of the ‘Diputacion Provincial’ (Association of Municipalities) in Ciudad Real, has confirmed that more and more people are seriously affected by hunger. A plan to provide for ‘social emergency’ has been prepared, resulting in 2 million euros worth of foodstuff being distributed by town halls and non-government organisations. In 2010, 1,724 families were assisted, but the number in need has since risen.

Each family receives monthly assistance worth 30 euros per member.

Black economy 23% of total

Technicians in the Ministry of Finance have estimated that the so called ‘black economy’

in Spain represents 23% of the total, or 240,000 million euros. The largest areas of fiscal fraud are in the purchase/sale of properties by promoters, estimated at 8,600 million per year; one million rentals not declared and sales by small businesses.

Big fortunes ignore tax amnesty

Lawyers and fiscal consultants representing those with big fortunes in Spain have not taken up the offer of the government to repatriate funds they have hidden away in foreign accounts, by paying a back a one-off tax of just 10%. The government hoped to collect 2.5 billion tax income from this amnesty, however, those affected are holding out for better terms.

Chaos in Greece continues

Greece is facing a debt repayment to the European Central Bank of 3.8 billion dollars in August. With a recession that has gone from an expected 4.2% to a terrible 7% this year, the new government (of old faces) is having difficulties scraping together the funds. This situation, without doubt, will have an impact on Spain.

PP government pardons PP mayor

The government has given a pardon to the former mayor of Valle de Abdalajis (Malaga) who in 2009 was sentenced to 2 years imprisonment and 10 years prohibition from holding public offices, for a number of urban planning crimes.

Judges and prosecutors joins protests

The four Associations representing Judges and the three representing Public Prosecutors have joined the protests against the Rajoy government cuts, and the Association of Court Secretaries has also recommended their members to participate in the public demonstrations.

The Association of the Guardia Civil Officers supports the protests too, and also recommend it’s members to participate in the demonstrations.

Spain European Champion in misery

Eurostat reports that Spain is the European champion of misery. On the periodical index, which measures unemployment and inflation (The index of Misery) Spain is shown as having 26.4%, in front of Greece 24.1%, Latvia 19.6 and Portugal 18.6.

The full restaurants, bars and luxury shops in Spanish towns do not reflect a true picture of the misery in Spain, as the upper 10% of the population are not affected by the crisis; overall expenditure is down by one third.

Brand ‘made in Spain’ losing attraction

Since 2008, in the European market, the ‘Made in Spain’ brand-mark has been in a process of devaluation. Today ‘made in Spain’ products sell for 10% less than similar French products, and 20% lower than products ‘made in Germany’.

The Community of Owners

The College of Property Administrators Outstanding reports that fees to Communities of Owners which stood at 1,000 million euros in 2010, increased by 31.2% in 2011, to 1,350 million. The administrators also report a delay of 141 days in the payment of fees. They expect debt will increase to 1,600 million during 2012. I n Madrid 61.1% of the non-payers are property developers and builders who have gone bust.

In June, the President of the urbanisation El Pinar in the Valencia Region, gave owners 4 days to pay their fee debts, or their properties would be embargoed and sold at public auction. The number of auctions resulting from non-payment of property fees is rising fast, an several Communities have cut their expenditures to the bare minimum to avoid such situations.

Action against illegal letting

Many owners are renting properties direct to holidaymakers with payment being made to an account in a foreign bank outside Spain. The Government is aware of this set up and has recently passed a law, ‘Ley de lucha contra el fraude fiscal’, whit carries a minimum fine of 10,000 euro on the contributors not declaring their accounts abroad. This applies to both residents and non-residents with income from letting a dwelling situated in Spain.

With the despairing lack of tax income, you may expect a hard drive by the tax inspectors to collect.

But even if you are prepared to pay the taxes, you may not be able to let out your property. Some of the regions have passed laws to prevent private lets, to protect hotel owners and letting agencies.

In the Balearics you can only let legally if you are the owner of an apartment registered as ‘apartamento turistico’, but not if it is classified as ‘residencial.’ Real estate agents and promoters often did not explain the consequences of this difference in classification to buyers.

If you own an independent villa in the Balearics, you may rent it out, but only if you have applied for a permit by the department of tourism in Palma. According to recent reports, the issuing of rental permits has been suspended, and thus many owners let illegally.

On the Canary islands we have a similar situation. Letting of residential apartments is prohibited and you need a permit to let an individual house. Tourist apartments can be rented out, but only through a registered letting agency which controls the letting of at least 50% of the properties in a project.

17 inspectors are searching for illegal letting of an estimated 400,000 ‘illegal’ and another 600,000 ‘clandestine’ beds supposed to exist on the Canaries. Fines range from 30,000 to 300,000 euros.

A confusing situation

Due to the right of the regions in Spain to legislate on tourism, we have a very confusing situation. What is allowed in one region may well be prohibited in another, however, in general, the mainland regions are not as rigid as the islands, although, even there we have the distinction between tourist apartments and residential ones. We have previously reported on foreigners living `permanently’ in their own dwellings, being evicted due to them having bought an ‘apartamento turistico’ that may not be used for permanent occupation.

The rules on the letting of dwellings in Spain is a minefield, which we recommend foreigners not to walk into. Moreover, if you are doing a legal letting, the net income hardly ever gives you a proper interest return on the investment.

The Property Market…..

….does not exist anymore!

It was my intention to also write about the foreigner’s property market in this Summer Report, however, after researching several sources, I had to conclude that it no longer exists ! Of course, there is are endless number of properties for sale, but due to an almost total lack of real buyers, the market has vanished. Private foreign property buyers as a distinct group do not exist anymore !

The ‘sniffers’

What we have are some foreigners visiting the few remaining real estate agents (surviving mainly from letting, administration and tax consulting) ‘sniffing’ to see if there are some bargains to be found, offered by Spaniards or foreigners not being able to pay rising taxes and fees or the next instalment on the mortgage. And as always, we have the big scavengers, investment funds wanting to buy hundreds of dwellings from broke promoters or banks which lent the builders vaste amounts of money and are now saddled with bricks of little value or building land worth even less.

Realia, the big real estate company owned partly by Bankia (which had to ask for public funds to survive) lost 9.5 million euros in the first half year (down from a profit of 11 million in the same period last year) due to income from he sale of dwellings falling 80%. The company has financial debts of 2,179 million, which it is now trying to renegotiate. The situation of Realia illustrates very well the condition of the market.

Growing potatoes on building land

Lorenzo Castilla, Commercial Director of another big property company, Vallehermoso, declared recently that land approved for construction was worthless if situated outside a town centre, and fit only to be used for agricultural purposes. Prices for land in town centres has fallen 50% since 2007.

Some promoters are still clinging on to the hope that ‘the market is coming back’ keeping their mega projects on the back burner, supported by municipalities that desperately need the tax income from such projects to pay their monumental debts.

During the property bubble, land sales amounted to 20,000 million euros a year. In 2011 it was down to 7.,000 million (mostly transfer of land between broke promoters and the bank that financed the adventure).

The main reason why the Spanish banks had to be rescued to the tune of ‘Up to 100 billion euros’ is the useless land they have inherited from the many failed property developers. Troubled Bankia (and its mother company BFA) has 18,000 million euros of worthless building land on their books, whilst Banco Sabadell (including failed CAM) has 11,000 million.

‘Buyers for everything!’

During the property boom, when a property promoter had to explain to the bank or the public why he wanted to build 500 dwellings (and a golf course) in a remote creek, one could often hear the phrase, ‘There are buyers for everything.’ For a brief period there really were buyers for everything, after the public had been told that millions of families in northern Europe wanted a home in the south and that property prices in Spain could only go up. Or they were assured that this specific project had a termination guarantee from a bank, a letting income guarantee from a property rental company and that clients should buy at the beginning when prices were low – and they could resell later at a profit !

Today there are many unfinished property projects in forgotten creeks, with no buyers and no owners living there, with deteriorating infrastructure (if it ever was finished) and decaying dwellings.

And many foreign buyers are left with a hundreds of thousands euro hole on their bank accounts.

And the prices?

5 years after the start of the crisis, prices are just going one way: down and further down. The non-selling property experts Acuña & Asociados, estimate there are 2 million dwellings for sale in Spain, and building land for another 3 million. They think prices will continue to deflate until 2015.

The good news is of course that there are almost no new applications for building permits. In the first 5 months of the year, the Colleges of Architects received only 22,049 applications for the construction of new dwellings, down 35.9% from the already bad last year.